Nice Article, Must Read.... House of Cards crumbling, Bring your own popcorn to the movie...

Article Link

The numbers are all moving in the wrong direction for developers in Asia's third-largest economy. Debt levels are rising as sales volumes and profits fall. Banks are shutting their doors to the industry just when it needs cash the most. Prices are stagnant and expected to fall.

"The marketplace is not foolish," said Lodha. "A price correction will happen naturally."

===

"Are there going to be months where companies might have to delay paying their interest? Yes," warned Lodha.

==

In early 2008, DLF, with a market capitalisation that peaked at over 2 trillion rupees ($40.6 billion), announced a fiscal year profit of over $1.5 billion - an annual increase of over 300 percent - thanks to an insatiable appetite for property.

But times have changed. With a market capitalisation that has shrivelled to $8 billion, the firm has turned to selling the family silver. Amanresorts, the luxury hotel chain it bought in 2007, is on the block as part of plans to sell $650 million of assets by March .

It is expected to announce the sale of the prime 17.5 acre plot adjacent to the World One site in December, two sources with knowledge of the matter told Reuters.

===

Real estate, which has garnered a growing slice of India's foreign direct investment (FDI) pie over the past few years, from 8.9 percent in 2007-08 to 11 percent in 2009-10, accounts for just 6 percent of the FDI this financial year, according to Ernst & Young.

India's realty index has fallen more than 36 percent since January, more than double the 17 percent slide in the benchmark Sensex , pouring cold water on the roughly $6 billion worth of planned initial public offering from developers.

Lodha's planned $570 million IPO has been stuck on the shelf for nearly two years.

More than $370 million in hoped-for IPO proceeds had been earmarked for construction costs, with another $61 million set to repay loans. That money has had to come from elsewhere.

Private-equity investors, which have poured $10.2 billion into developers since 2006, are set to withdraw around $5 billion in the next few years, forcing top developers including Lodha, Shriram Properties, DLF, Phoenix Mills and Unitech to buy back their investments, a Nomura report said in May.

===

But they may not be able to hold out much longer. "The current market sentiments and excess debt levels at high interest rates, against seriously impacted volumes, should bring about an immediate 10-20 percent price correction," said Sanjay Dutt, CEO, business , at property consultants Jones Lang LaSalle India.

"That means taking a cut in profit or accepting a loss on some projects ... We are likely to see some developers default on their debt," Dutt said.

Saturday, 29 October 2011

Thursday, 20 October 2011

Allotment of additional 33% FSI in Mumbai suburbs to correct realty prices

Move to bring down TDR prices, curb cartelisation

Mumbai's realty sector has received a much needed boost as the Maharashtra government has announced a crucial decision to allot 33 per cent floor space index (FSI) in suburbs for premium. This is expected to substantially bring down the TDR (transfer of development right) prices, increase housing stock and reduce their prices.

Besides, the move would generate an annual revenue of up to Rs 5,000 crore from the recovery of premium to be shared by the state government and the Municipal Corporation of Greater Mumbai (MCGM). Initial estimates by the state government and the realty sector show that the allotment of 33 per cent FSI would increase in supply of TDR to the tune of 10 millionsq ft annually. Prices of residential properties are expected to fall by Rs 500-1000 per sq ft with the correction in TDR prices.

Chief minister Prithviraj Chavan told Business Standard, "The government had already completed the legislative part by amending the Maharashtra Regional Town Planning Act during the winter session of the legislature last year.

It was not implemented as the government thought it fit to seek a second opinion as there was a view that it may put pressure on existing infrastructure. However, the MCGM commissioner gave his view in favour of the allotment of 33 per cent FSI in suburbs for premium."

Chavan, who was speaking at the sidelines of investor after care conference organised by Maharashtra Economic Development Council, said this would help correct realty prices and also lead to increase in housing stock.

A government official recalled that the Bombay High Court had last year quashed the rule saying that it had no right to levy premium under the existing Act. After the High Court order in June last year, constructions with additional FSI had come to a standstill, forcing the government to issue an ordinance. With the amendment in the MRTP Act, the planning authority would be in position of levying premium against additional FSI of 33 % given to the builders executing projects in suburbs.

Realty industry has welcomed the government's move. Sunil Mantri, former president of Maharashtra Chamber of Housing Industry said "It was a long pending move. It comes at a time when the TDR market is highly volatile in Mumbai, Very few players control and decide the TDR price. About two years ago TDR prices had increased to a level of Rs 4,250 per sq ft which was resulted in the utilisation of TDR unviable. The current prices of Rs 2,700-3,000 per sq ft are also discouraging for may realty players." However, he informed that with the government's decision realty players are expected to pay a premium between Rs 1,200 and 2,000 per sq ft. Immediately after the premium payment the realty players would get TDR utilisation certificate.

Mantri said the government move would help create more TDR stock in middle segment which would reduce TDR prices. "In view of fall in TDR prices, realty players will be able to pass down benefit to consumers and the prices are expected to fall by Rs 500-1,000 per sq ft," he noted.

Yomesh Rao, director YMS Consultants Limited clarified that the 33% FSI was not above the cap of FSI 2 in suburbs, "It is just replacing the TDR at Rs 2,900 per sq ft by FSI premium at Rs 600 to 1,200 per sq ft from Andheri and Dahisar. The premium collection of well over Rs 2,000 crore annually can be used for the betterment of the city." He added that this would marginally affect the TDR cartel as TDR was still very much a required commodity.

Rao said the government's move is a win win for the Mumbaikars, the state government and the realty players.

Ashutosh Limaye, head for research at Real Estate Intelligence Services, said "There will be lesser dependence on TDR which will be reduced now to .67. The allotment of 33% FSI at premium is very transparent and the rate will be as per the ready recknor rate which are revised every year in January. It is transparent and fixed rate and not subject to demand supply situation. TDR rates will come down and the realty players in the present conditions are expected to pass down benefits to consumers."

Rajesh Raha, managing director Raha Realtors shared views of Rao and Limaye. He noted that "This will increase lot of development potential in suburbs. TDR price will reduce and we hope the realty players to pass down benefit to the actual users."

Monday, 10 October 2011

Quick look at the bubbles elsewhere

As recommended by a commenter in the last article here is some news about property bubbles in emerging markets (also I want users to post new comments here) - most links from the last 2-3 weeks

Property

BRICS other than India

Non Brics

Other bubbles

Developed world economy - Lost decade(s) looming

Fresh bout of gloom and doom. Remember the last time the world was in this rut was in 1937 and it took a world war to come out of it ...

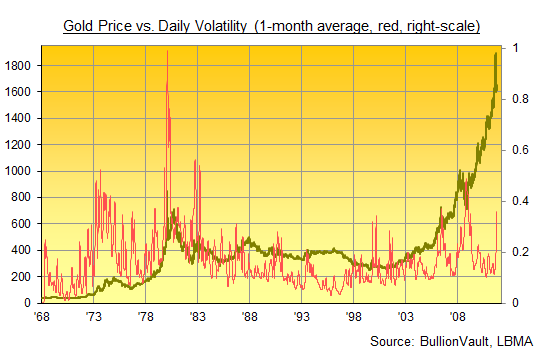

Gold price over the decades

Property

BRICS other than India

- http://www.marketwatch.com/story/property-gloom-deepens-as-china-holiday-ends-2011-10-07

- http://in.reuters.com/article/2011/10/09/idINIndia-59759220111009

- http://www.time.com/time/magazine/article/0,9171,2096345,00.html

- http://brazil.homesgofast.com/news/seven-brazilian-cities-seven-real-estate-rises-I2303/

- http://rbth.ru/articles/2011/10/05/bricks_and_mortar_back_to_the_bubble_13538.html

- http://housepricesouthafrica.com/graphs/

- http://www.brazilianbubble.com/

Non Brics

- Canada http://www.canadianrealestatemagazine.ca/news/item/828-bubble-talk-on-the-rise-in-canada

- http://thehousingbubbleblog.com/?m=20111007

Other bubbles

- Commodites http://www.economonitor.com/lrwray/2011/09/27/is-the-commodities-bubble-a-case-of-index-speculation-by-money-managers/

- Chinese internet and Tech bubble http://www.forbes.com/sites/panosmourdoukoutas/2011/09/30/the-chinese-internet-bubble-is-busting/

- Indian Internet bubble http://www.businessinsider.com/india-tech-reaches-near-bubble-stage-2011-10

- US bubble #3 - Groupon, Facebook, Netflix. Google, Twitter, Zillow, Zynga, No comments on this http://www.theregister.co.uk/2011/09/20/bubbles_and_silicon_valley

- http://www.nytimes.com/2011/10/10/business/global/households-pay-a-price-for-chinas-growth.html?ref=world

Developed world economy - Lost decade(s) looming

- Back To Mesopotamia http://www.bcg.com/documents/file87307.pdf

- http://www.zerohedge.com/news/muddle-through-has-failed-bcg-says-there-may-be-only-painful-ways-out-crisis

- Merkozy and the Greek tragedy http://www.telegraph.co.uk/finance/financialcrisis/8782663/Debt-crisis-live.html

Fresh bout of gloom and doom. Remember the last time the world was in this rut was in 1937 and it took a world war to come out of it ...

Gold price over the decades

USD INR

(courtesy Bullion Vault)

(courtesy Bullion Vault)